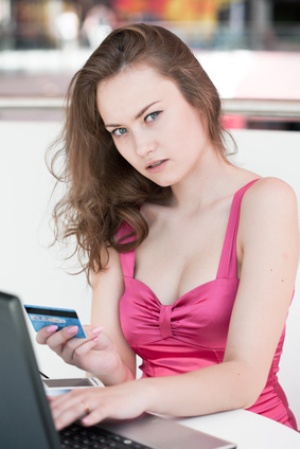

Perhaps the most frustrating aspect of a credit card is that you have to wait anywhere between days and several weeks to find out if you qualify for one. You do not want to complete a dozen different credit card applications but you also do not want to put all of your eggs in one or two different baskets and then end up with no credit cards to your name. Thankfully instant approval credit cards are becoming more and more popular, thanks in part to the rise of the internet. These days you can find an online credit card application, apply for the card and know instantly whether you qualify for it or not. In this article you will learn the pros and cons of instant approval credit cards and I’ll give you a few suggestions as to which cards are the best.

Pros: Instant approval credit cards obviously have one thing going for it, you can know instantly whether you get the card or not. Most online applications take less than fifteen minutes to complete which is very important. You should receive a response via E-mail or a phone call within 60 seconds of completing your application, which is great. Given the choice, who would choose to wait over a week for a decision on an application versus getting a near instant response?

Sometimes stuff in life just “happens” and you find that you need an amount of money you do not have. Everyone should have a large financial “emergency fund” that should last one 3-6+ months, but that is not feasible for some. In this situation you can either apply for a payday loan or apply for a credit card. You have a better shot at being approved for the payday loan, but why would you opt to pay 15-20% weekly interest on an amount of money over 15-20% yearly? Apply for an instant approval credit card and you will know in seconds whether you qualify for the card.

Cons: Credit card companies know how important getting an instant decision can be for many consumers so they often use this to their advantage. When you are looking for an instant approval card two things are going through your mind, the first is: “Where can I find an instant approval card”, the second thing going through your mind is: “Is this card for me?” You are not looking over the fine print of the credit card to make sure that there are no hidden loopholes, extra fees or phony bonus points, you simply want to fill out an instant approval credit card application. Instant approval credit cards tend to come with higher APR’s and they have less to offer consumers in terms of rewards, points, and cash back…

There is a way of getting around this “con”, simply be diligent when looking for credit cards. Read the fine print, even if it takes you 5-10 minutes. You want to know what you are getting yourself into no matter the financial situation, especially when you’re talking about something as important as a credit card. Make sure that the APR listed is the APR you will get, not an introductory rate that only lasts for a short time. Be thorough in your research, you should definitely know if there are any annual fees associated with the card and the monthly limits as to how much you can spend and how high of a monthly balance you can carry. Credit card companies often times try to take advantage of people in this situation, but with a little foresight you can be the one to get the deal.

Here are three instant approval credit cards you should consider:

Blue from American Express

You have likely seen this card advertised on television. This is a very popular card and you will get an instant decision if you apply online! This card gives you a 0% introductory APR for up to 12 months, after that you will experience a reasonable APR of 15-19%. There is no annual fee with this card and making purchases with this card will qualify you for Membership Rewards that you are sure to put to good use. This is a “standard” credit card with little bells and whistles, but it has everything you need!

Orchard Bank Classic MasterCard

This credit card is vastly different than the card listed above. You will likely end up with an APR around 20% and some will have to pay an annual fee based on how often you use the card. However this card is great for those of you with poor credit that only has two real options that I listed above, use a credit card or take out a payday loan for an emergency, one-time expense. This card will help you build your credit score as long as you consistently pay off your balance as well.

Zync from American Express

This is another American Express card that gives you an instant decision! This card has exactly what you are looking for, but it is only for those of you with very good credit. If your credit score is not at least at 700 you should apply for credit card #2, the Orchard Bank Classic Mastercard. Zync has a mere 25 dollar annual fee and you will pay no interest on the card as long as you pay off your monthly balance each month. You can customize the card to meet your needs and you will earn 10,000 membership reward points on your first purchase, no matter how big or small.